How Meta Turned AI into a Profit Machine, and the Three Big Clouds vs the Neo-AI-Clouds

Developments in AI

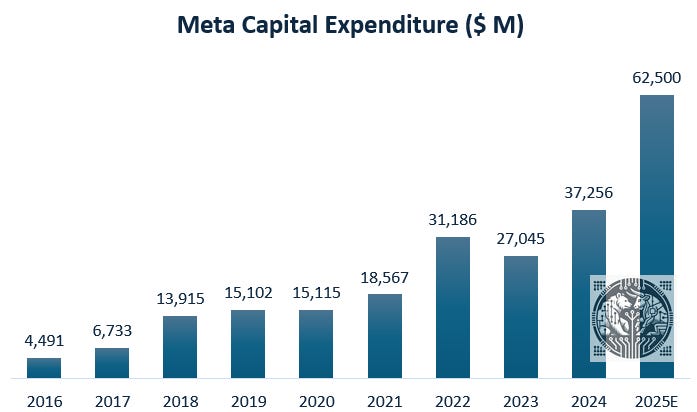

“We expect to bring online almost a gigawatt of capacity this year and we're currently building a 2-gigawatt and potentially bigger AI data center. We're planning to fund all of this by AI advances that increase revenue growth.” — Marc Zuckerberg, January ‘25

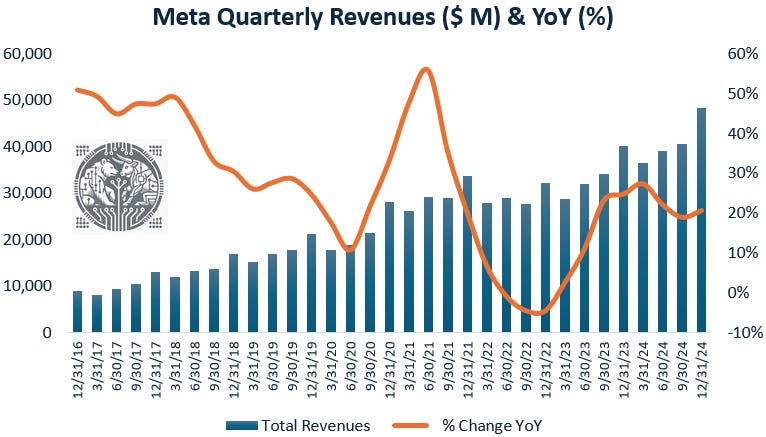

In late ‘22, the market reckoned that Meta had gotten itself in a precarious situation. Revenue growth had evaporated while the company was investing heavily in the Metaverse pipedream. In addition, there was a clampdown on user tracking by Apple and its ATT policy, and also with Google looking to ban cookies at some stage, which raised doubts about Meta’s future ad monetization growth.

Meta’s business performance actually wasn’t that bad. The covid lockdowns had created a boom for online platforms, and a cyclical pullback was always likely when the world returned back to normal. This in combination with Apple banning user tracking by apps, honestly, it was a strong performance that Meta managed to hold its revenues flat in 2022. It looks like the successful roll-out of business messaging over WhatsApp and Messenger saved the day, or otherwise share prices would have headed even further south. The new business-messaging product was already at a $9 billion annual revenue run rate by Q3 of ‘22, when the shares hit their 7-year low.

Also Reels was generating over $3 billion in annualized revenues already, but these new TikTok-like short form videos were actually cannibalizing Facebook’s Feed and Instagram’s Stories. At that time, the latter two enjoyed much superior ad monetization, causing a $2 billion revenue headwind for the overall business. Meta first tends to scale a product up and make it popular, and then afterwards starts to think about how to maximize profits.

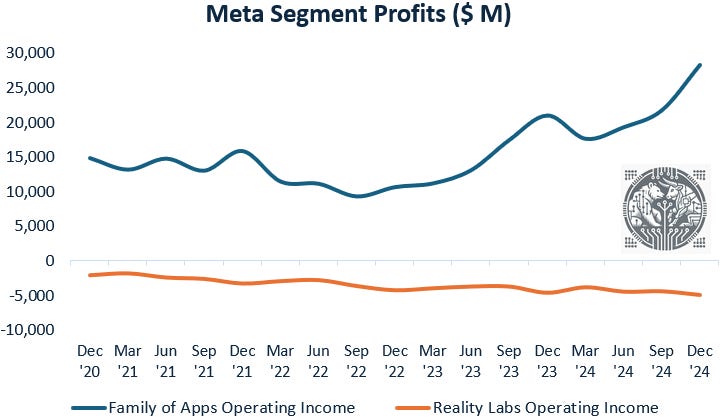

What especially spooked the market were Meta’s heavy investments in R&D, and especially the Metaverse. The latter continues to burn huge amounts of cash up to this day.

However, we can see that post the 2022 trough, Meta’s family of apps saw spectacular profit growth. The share price reaction was the same, with the shares going up 7-fold since the market completely misread this situation in late ‘22.

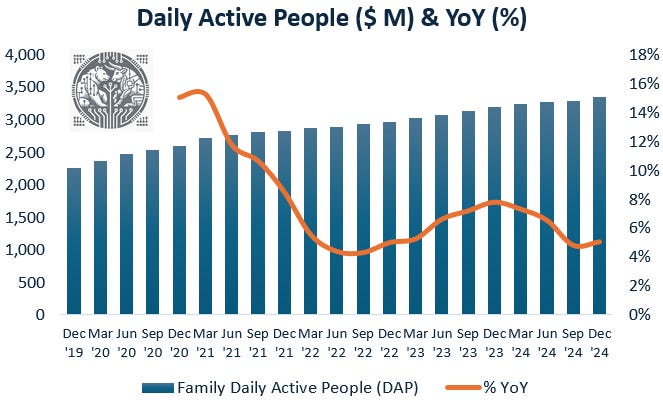

And all of these additional profits are coming from better monetization strategies, as Meta’s user growth remains modest. The other point to note here is that most of this user growth is coming from poorer regions, basically from countries where parts of the population are only now able to purchase their first smartphone. So while these boost user growth, the business value of these users is currently slim. Meta makes a lot of money by showing users ads of ecommerce products, and then users go to the advertised site within a few days to make the purchase. The advertizer then attributes this sale to the Meta ad they showed, and then decides to purchase more ads.

So while the investments in the Metaverse have been a pipedream so far, the investments in R&D - and especially AI - are paying off. The basic idea is to create a more engaging user feed which increases time spent on the various apps, thereby increasing ad revenues. For example, already in Q2 of ‘22, a single AI advancement in Facebook’s recommendation model led to a 15% watch time gain for Reels. The other revenue driver is to serve better ads with AI. The basic idea here is that more customized ads for a particular user increase ad engagement.

These advancements led to a large jump in Meta’s AI capacity already in ‘22, and with another massive jump coming this year. Obviously this is bullish for Broadcom and Nvidia.

For premium subscribers, we’ll go much deeper into Meta’s AI capabilities. We’ll also discuss Amazon’s vision for the future of AI. And finally, we’ll give our thoughts on whether it makes more sense to invest in the three big clouds — Amazon AWS, Microsoft Azure and Google Cloud Platform — or in the neo AI-clouds such as Nebius.

A former data scientist at Meta gives further details on Meta’s AI capabilities, this is an expert via Tegus:

“The start of really putting emphasis on GPUs started around 2019 with the first super compute cluster, RSC. That's the primary cluster that was used to train all our content recommendation models, ads models and computer vision. That built-out was fairly complete in late '21. For inference, everything was on CPUs. Back then, the models were never hitting a billion parameters. Even the ad models, which were pretty much the most complex models that we had at the time, those were still in the hundreds of millions of parameters.