Business Overview

“Don’t bet against Elon” - Peter Thiel, 2018

Tesla almost needs no introduction, as this is the company which revolutionized the automotive industry with the popularization of electric vehicles (EVs). Arguably the biggest change in the industry since Henry Ford started manufacturing on assembly lines. However, describing Tesla as purely an innovator in electric vehicles would be an oversimplification. The company has also implemented a radical new business model with extreme amounts of vertical integration. Its corporate culture is one of the greatest cost discipline, combined with a continuous drive for product improvements and increasing levels of automation.

Currently, the model 3 and Y are the bread-and-butter of Tesla, generating most of the company’s cash. The model 3 is Tesla’s cheapest car, with starting prices of around $40k. But despite this more affordable price level, it still has all the advanced tech which Teslas are known for. Model Y is basically an SUV version of the model 3. The two luxury vehicles are the model S and X. Model S has been in production since 2012, with the model X being an SUV version introduced three years later. Both models have seen upgrades over the years giving them a better look as well as better tech.

Tesla’s strategy was always to first penetrate the luxury segment as initially, due to the low volumes of production, the costs of producing a new type of vehicle would be unusually high. Then as the company built brand and scale, a more affordable and high volume vehicle would be developed.

This is where we are now, however, the story isn’t over yet. The most enticing prospects for investors are twofold in my opinion. Firstly, in the near future there will be the launch of an even more affordable vehicle, with a likely price level of around $20 to 25k. Which should the bring the possibility of owning a Tesla within reach for most. The vehicle, like all of Tesla’s other models, will have the needed hardware for a full self driving system built-in, which via software updates over time will hopefully give the vehicles full autonomous driving capabilities. Currently this system is still in the beta version, so drivers have to keep their hands on the steering wheel at all times to make corrections where needed.

The second enticing prospect for investors is if fully autonomous driving capabilities can be successfully developed. Under this scenario, the company could launch a robotaxi service, and also implement a subscription model to use the software, giving investors an attractive stream of recurring revenues. Needless to say this would be an extremely interesting business to own. However, not only Tesla but the entire automotive industry has continuously been disappointing on this prospect. Around 2018, word in the tech world was that autonomous driving was ‘just around the corner’. A variety of companies such as Baidu were promising the market a robotaxi service could be launched by the end of the year. In the meanwhile, five years later, progress has been rather limited with services running in only a few US and Chinese cities.

Other potentially interesting businesses for Tesla investors include Dojo, a supercomputer which is used for AI training. Optimus, a humanoid robot with the aim of it being able to take over a large variety of manual tasks. Megapack, which are industrial scale battery systems to store renewable energy. These will be needed to power the economy with solar and wind. Lastly, Tesla has the largest charging network in the world which recently has started opening up to all electric vehicles.

On top of that some further products are due to be launched. Such as the famous Cybertruck and the Semi, a fully electric truck. The cybertruck is due to start production later this year at the Texas Gigafactory. And production for the Semi is already in process with the first deliveries being underway.

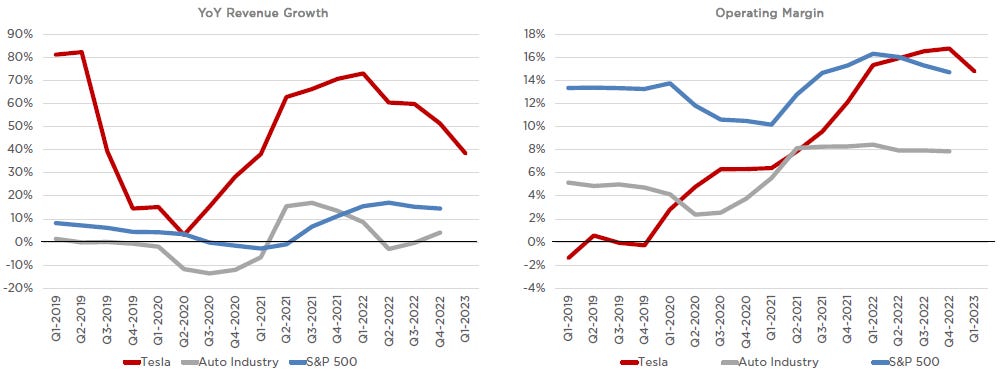

Tesla has strongly been outperforming the automotive industry and is now generating operating margins at twice its level, illustrated in the chart below. The company’s large advantage in sales and marketing costs is easy to understand. Whereas competitors have to buy expensive advertising, Tesla spends zero on advertising and sells largely via word of mouth. And whereas the traditional manufacturers sell via a dealer network, which takes a profit cut, Tesla sells directly to consumers online with the cars being driven to their doorstep.

The advantage of this online sales model is that the company knows the demand for their vehicles on a real-time basis. Allowing them to make regular price adjustments. In recent times they’ve been frequently using this option to adjust to demand. On the contrary, other car manufacturers get this data with a lag as there is a back and forth between them and their dealer network. Tesla estimates their SG&A cost to be around 65% lower on a per vehicle basis compared to a traditional automotive manufacturer.

The second advantage Tesla has is in manufacturing. Most of the components are designed in-house, from large single-piece vehicle structures to small parts optimized for a single task. Only a large scale player has the abilities to implement such a strategy. Once you’re in a position like this, this both brings large cost advantages as well as product performance gains. Whereas rivals such as Rivian and Lucid are burning incredible amounts of cash, Tesla is printing it. The only car manufacturer that I’m aware of that making money in EVs, is Chinese large scale player BYD. And its margins are rather thin at around 4.5%.

Due to the loss-making EV activities of other manufacturers, Tesla is an extremely strong position to capture a large portion of the lower priced segment with its next-gen vehicle. From a recent Forbes article:

“Automakers have been ditching small, affordable, low-profit vehicles for larger, pricier and higher-profit ones (gas-powered and electric) for years, but the process has greatly accelerated since 2018. This transition is most obvious among the rapidly dwindling ranks of small cars, of which the Bolt EV is one of the best (even if Chevy insists it’s a crossover), but it also highlights how few affordable EVs there really are. In 2023, and counting the Bolts, there are just five models that retail for under $40,000, none of which qualify for tax incentives. The Bolt’s passing will leave a major hole in the market.”

The same article makes some interesting analysis on the low priced EV market. This leads me to conclude that a capable Tesla vehicle with a decent range won’t face much competition here:

“Once the Bolts are gone, the least expensive EVs on the market will be the Mini Cooper SE ($31,895 for 2024) and Nissan Leaf ($29,145), both of which have much shorter driving ranges (114 and 149 miles, respectively, though pricier Leafs get more range). There are only two other EVs on the market for less than $40,000 in 2023, the Hyundai Kona Electric and Mazda’s MX-30. The redesigned 2024 Kona Electric will be larger and pricier, while the hapless, 100-mile-range Mazda is only available in limited quantities in California.”

A culture of hardcore engineering

"Taking the skin off the Model Y, it was truly a work of art, it's unbelievable" – a Toyota executive

Do me a favor and hit the subscribe button. Subscriptions let me know you are interested in research like this, which is a good motivation to publish more of the analysis I’m carrying out. Special thanks to the 400 subscribers so far!

Just like the Roman army was capable of extreme feats of engineering, Musk has instilled a similar hardcore culture at Tesla. For example, Over the last five years, they reduced the weight of the model 3 powertrain with 20%, lowered its usage of rare earths with 25%, and reduced the size of the factory floor where this unit is produced with 75%. Recently the company announced that the motor’s magnet won’t use any rare earths at all. Whereas the US military is still reliable on China here, Tesla is able to phase them out. Resulting in the company being able to bring the cost of their powertrain down to about $1,000. They reckon no other automaker is close to that number. Overall, Tesla estimates that their vehicles go 25% further for every unit of energy input.

Whereas other manufacturers typically operate in silos, at Tesla all of the engineering teams work together on projects:

“That collaboration pushes us from day one to design products that are not only high performance but are really easy to assemble. We have small and highly capable teams and to make a critical decision we can have the battery cell chemists, the mechanical engineers, the manufacturing engineers, the supply chain team, the automation designers and the software programmers, all in one room working together in real time. And that allows us to make decisions that are best for the whole car and to make them really fast. That approach is unlike traditional automotive engineering which is really fractured. If you were to go buy like a premium German electric car, the engineers who designed the drive inverter in that car, they did not work for that car company. They worked for a contractor.” - Tesla’s head of powertrain.

Power electronics are extremely important in EVs to regulate the currents powering the vehicle. This is where silicon carbide comes in. Power semiconductors made from this material are extremely efficient at converting current. However, the main drawback is their price tag. At the company’s recent capital markets day, Tesla disclosed that they were able to reduce their silicon carbide based power semiconductor cost with 75%:

“We designed our own custom package and we can extract twice as much heat out of that package as what we could buy off the shelf. And so what does that mean? It means that the silicon carbide wafer that's inside those packages can be much smaller. And silicon carbide, it's an amazing semiconductor, but it's also expensive and it's really hard to scale. On top of that, orchestrating all of these transistors and making them switch in the right ways is computationally extremely intensive. It used to require 4 microprocessors. We have developed our own custom microprocessor, it's purpose-built for high-power electronics.” - Tesla’s head of powertrain.

The overall manufacturing footprint for the model 3 has now been brought down with 40%. Allowing Tesla to build factories faster and with less capex, resulting in a higher return for every dollar invested.

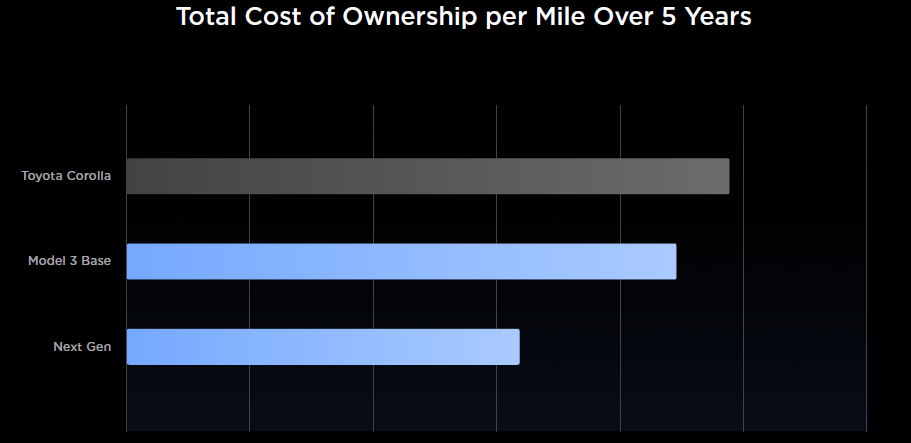

All the above mentioned gains reduced the model 3’s production cost with 30%. Tesla now estimates this model to have a lower total cost of ownership than the Toyota Corolla, the best sold car in the world:

With the next-gen vehicle, they are planning to take this approach to the next level. Whereas with the model 3, around half of controllers were designed in-house, Tesla reckons that with the next-gen vehicle they can bring this number up to 100%. With further reductions in the manufacturing footprint versus the model 3. On top of that, the next-gen vehicle will be able to accept any battery chemistry. Allowing Tesla to make use of new types of batteries as they become available.

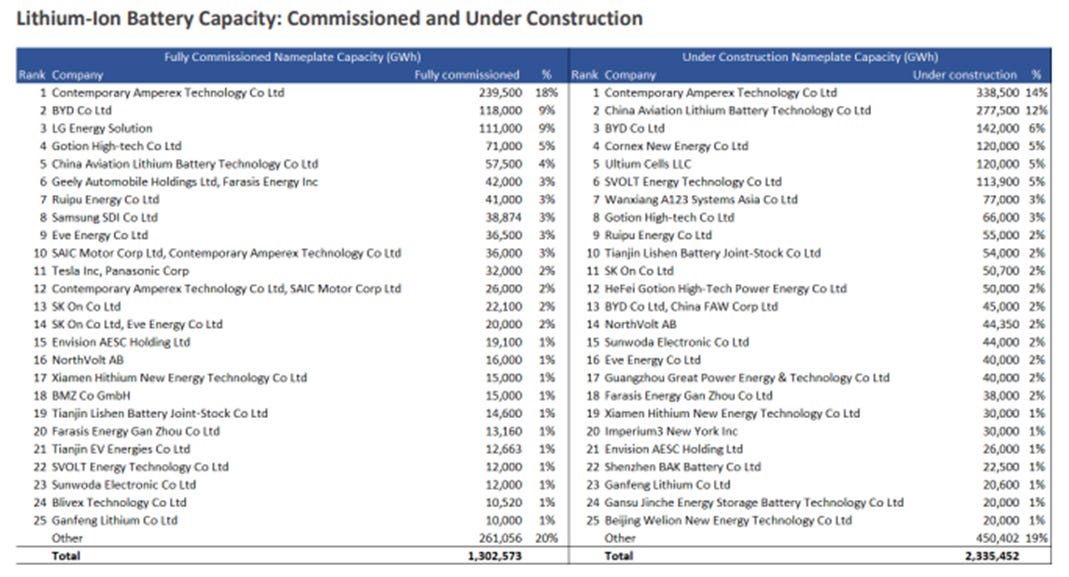

The battery industry is fragmented with an abundance of players and technologies. So Tesla’s decision makes sense here to keep their options open here. The top 25 players in lithium batteries are highlighted below, both in terms of current capacity installed as well capacity under construction.

However, new battery chemistries are under development. For example, there are next-gen lithium batteries, where smaller US based Enovix is trying to scale up production. CATL, the current lithium champion with an 18% market share, is also scaling up a sodium based battery. As is Chinese EV giant BYD. According to the Nikkei, another 30 companies are attempting to commercialize this same new type of battery. As another alternative, Tesla’s view is that iron-based batteries would do most of the heavy lifting in the electrification of the world.

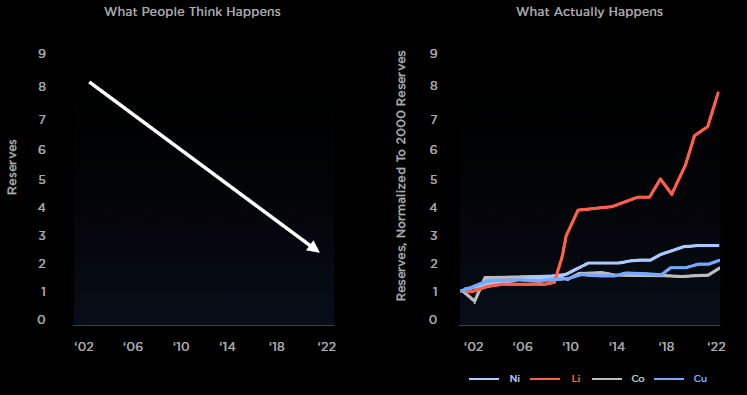

Contrary to some popular believe, we aren’t running out of mineral reserves. The more we look, the more we keep finding. Lithium is especially abundant. Iron even more so, with this element being the largest contributor to the Earth’s mass. Nearly 6% of our planet’s crust alone is composed of iron. Relatively speaking, nickel and cobalt are more scarce but new battery technologies are reducing their exposure to these elements. Additionally, there’s the potential to develop a more advanced recycling industry, by re-mining these elements not only from car batteries but also from disposed electronics. A process called urban mining.

Elon Musk: “On the lithium front, the choke point is refining capacity rather than mining. Lithium is very common throughout the world, including in the US. And this is why we're building our lithium refinery at Corpus Christi and our cathode refinery outside Austin. We will have, by far, the most lithium refining capability and the most cathode refining capability in North America. You only need nickel for basically aircraft, long-range boats and very long-range cars or trucks. But the vast majority of heavy lifting for electrification will be iron-based cells.”

Tesla takes a similar in-house approach with their usage of software. Third-party software is extremely comprehensive and capable but has as negative a high price tag. On top of that you can get further regular price increases. Naturally this is one of the reasons I’ve regularly been invested in software companies.

Tesla’s scale allows them to write most of their software in-house. The philosophy is that the software only has to be able to do what the company needs, and do that very well. As such they’ve written their own ERP system, with which they manage their financials, their supply chain as well as their human resources. Recently the company developed their own insurance software to handle claims and analyze customer risk data. They’ve also developed advanced mathematical software to run simulations on vehicles and components. Most other manufacturers will use Ansys for this.

Tesla reckons this gives them not only a strong advantage in their SG&A costs but also in their ability to scale their headcount. A typical company will have to buy more software subscriptions for each additional employee they hire. But with Tesla, the price tag of this is near zero.

The process of adding functionality to custom software seems to be well optimized at Tesla: “Sometimes there are examples where we say, ‘I wish we were tracking this piece of data.’ Well, it's a teams meeting away from the applications engineering team to make a request and then we can start tracking that data and make those changes. And so the feedback loop associated with process improvement inside the company is pretty astounding.” - Tesla CFO

The software in the vehicles is similarly written by the company. Since Tesla’s early days, whereas other car manufacturers were only starting to update their infotainment software, the company has been able to update every controller in the car over the air.

This same over-the-air pathway is used to send data back from the vehicles to the company for analysis. Which gives Tesla insights into how the fleet is performing in the field and how customers are using their vehicles. This analysis is then inserted into a feedback loop to re-design the car. For example, simulations can be run on all the different types of crashes vehicles can be exposed to. Not only the selected few types that regulators and consumer agencies test for. Redesigning for all of these has made, without any doubt, Teslas the safest cars on the roads:

This alone is an extremely compelling selling point.

This data is also used to price insurance premiums for clients. Tesla knows how safe any customer’s driving behavior is, and thus knows exactly what their risk of being involved in an accident is. So there is a direct connection between a customer driving in a safe manner, and him saving some bucks. From the Tesla website: “Many providers base your premium on information that has little to do with your driving. We base your premium on how you drive. Tesla does not share your data or monitor your location, your data stays with you.”

Industry Overview

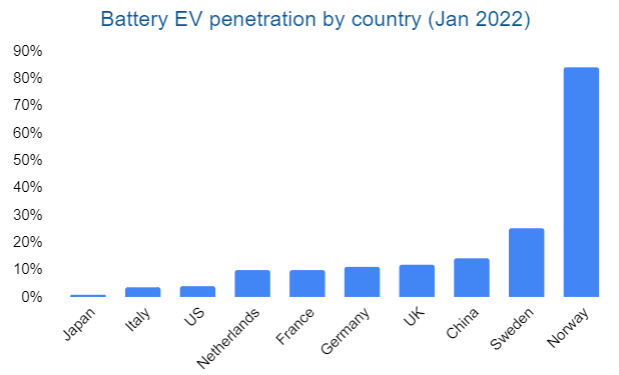

There should be a long runway of growth for Tesla. With the exception of Norway and Sweden, in most advanced markets, battery electric vehicle penetration rates are only around 2 to 14%.

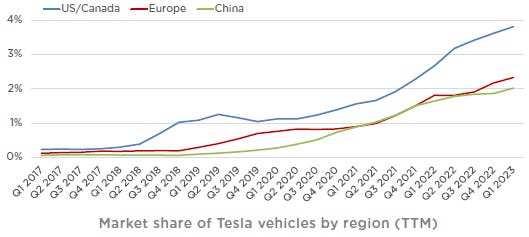

Tesla’s market shares in the overall car market are charted below. While in the overall market they have a rather low share, this is a function of the small size of the EV market. Within the EV segment, their market shares are strong.

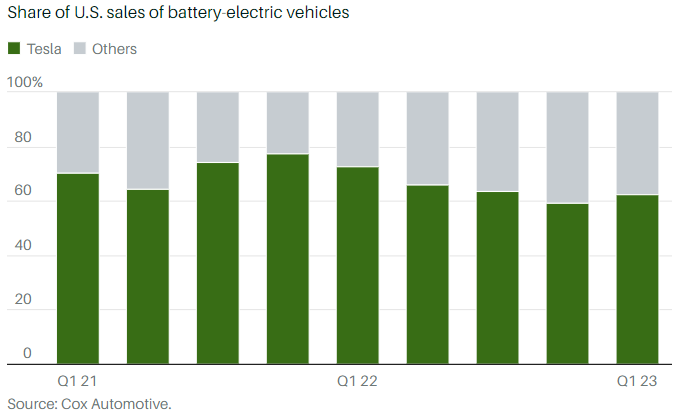

For example, in the US, Tesla has a market share of around 60%, illustrated below. Long term this won’t be sustainable in my opinion, as more car manufacturers such as the Germans, the Japanese, and the Chinese, amongst others, will launch more EV models.

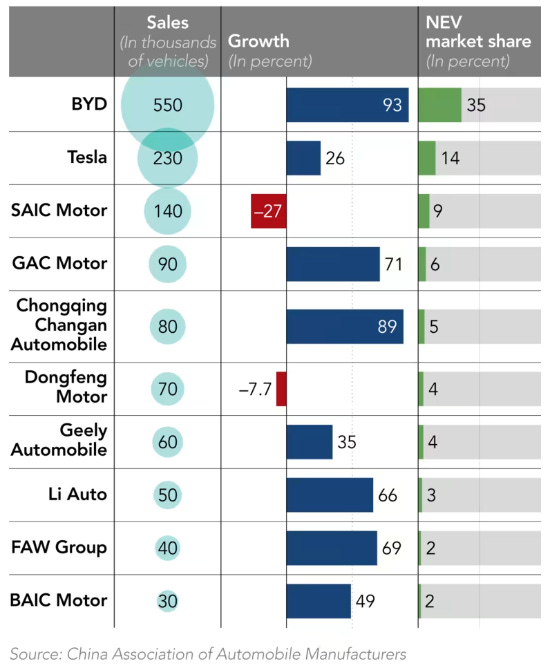

The Nikkei recently ran an article how they’re expecting a shake out in the Chinese automotive industry: “Local players in the world's largest EV market have sounded the alarm, projecting that the number of electric-car makers in China will shrink from around 200 to between five and 10 in the coming years. The shake-up is compounded by competition from foreign automakers. Volkswagen, BMW and Nissan all plan to introduce new electric models for China, where local EV makers account for 9 out of the top 10 by sales. Encouraged by government policies aimed at bolstering the emerging industry, about two-thirds of China's existing EV makers were registered between 2018 and 2020. Nio, Xpeng and Li Auto are among the poster boys competing against Tesla of the U.S. in the medium and premium segments. Others include domestic leader BYD, as well as subsidiaries of state-controlled automakers and independent brands.”

The same article reports the following market share data for the Chinese EV market:

Few companies within the EV market make money, Tesla is the only one generating solid margins. So this puts the company in an extremely strong position to drive the smaller fish out of the pond by lowering prices. Long term this will allow Tesla to capture a larger part of the market.

There are resemblances between Tesla and Apple. Although Apple operates in a notoriously competitive consumer market as well, they’re still occupying 57% of the market in the US and 24% worldwide. If Tesla wants to get close to these numbers in the long run, they would need to have a unique or differentiated offering. Such as for example, a fully autonomous driving service. This could transform the business into a ride hailing service or alternatively, a business with profitability being dominated by recurring software subscriptions.

Full Autonomous Driving

“We've now crossed over 150 million miles driven by Full Self Driving beta, and this number is growing exponentially. This is a data advantage that really no one else has.” - Elon Musk

Theoretically Tesla should be in the best position to crack the fully autonomous driving market. Machine learning is all about data. The mathematics behind the algorithms aren’t actually that complicated. Most of it was developed decades ago with some enhancements and additional techniques woven in over the last 10 years. The reasons behind the breakthroughs in AI over the last decade are twofold:

Firstly, due to the advancements in Moore’s law, i.e. the shrinking of transistor sizes, this allowed the gaming industry to develop ever more powerful GPUs. Scientists figured out later on that with such powerful chips optimized for parallel computation, we suddenly had the capabilities to run all these algorithms.

Secondly, to train these algorithms, large datasets were needed. With the popularization of the internet and a connected world, we suddenly had large amounts of data. For example, tons and tons of cat pictures. So by showing the algorithm thousands of pictures where a cat is, it learned how to recognize a cat. Note that this is somewhat primitive compared to a human brain. Obviously a computer can run very advanced computations. However, you only need to show a child once what a cat is. After this moment, the child can recognize cats of all sorts of breeds, sizes, and colors. The AI on the other hand needs to be trained on all these varieties in order to reduce errors.

Tesla has the needed hardware for full self driving already installed in their vehicles. So the company’s current viewpoint is that all what is needed to move these vehicles to robotaxi capabilities is an over-the-air software update.

The current software, which is more of a level 2 type driving assistant, meaning that you have to keep your hands on the wheel at all times, is called the beta version of full self driving (FSD). This beta FSD can be activated with an additional payment of $15,000. Tesla claims that driving with the initial version already brings in an 85% reduction in accidents relative to the US average. Online you can find a plethora of user reviews and videos making similar commentary, with the system reducing risk and accidents, such as spotting vehicles in a driver’s blind spot.

FSD beta allows Tesla to collect data of around one million miles per day with its vehicles being in autonomous driving mode. This should give it a strong advantage relative to competitors who are only running their robotaxi capabilities in a selected number of cities. For example, Waymo (Google) is currently only operating in parts of Phoenix, while Cruise (GM) is doing so in San Francisco. Tesla on the other hand is able to collect data and test their vehicles in a wide variety of settings across the globe. The company basically collects the same amount of data in a single day as Cruise and Waymo have in their entire lifetimes.

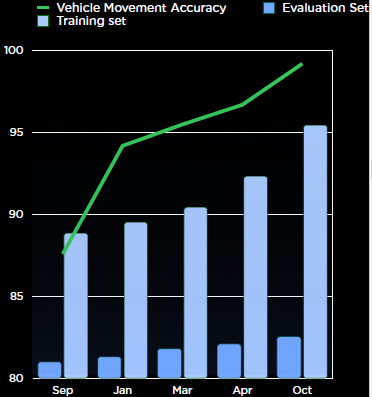

To train the FSD AI system, the company makes use of a 14,000 Nvidia GPU cluster. The below graph illustrates how as the dataset size increases, the movement accuracy of the FSD software increases. According to this chart provided by Tesla, its accuracy is getting close to 99%. This has led some other analysts such as Ark to put lofty price targets on Tesla shares five years out, on the assumption that we are close to a massive phase of growth, especially in profitability as the business moves to a robotaxi subscription service.

The other advantage for Tesla should be in their ability to attract talent. In a survey of US engineering students, SpaceX and Tesla were rated as the two most desired employers.

In two autonomous driving rankings carried out by UK car magazines, Tesla’s cars twice came out on top. Once the model 3 and the other time the model Y. However, not all self-driving tech is available yet in the UK..

General Motors claims to have a strong product with Cruise, which is currently operating a robotaxi service in San Francisco. I’ve seen some impressive videos of it with the car easily navigating crowded streets, such as those with pedestrians crossing at random. Waymo is now covering one third of Phoenix and is expanding their service to San Francisco as well. Baidu is operating a robotaxi service in three large Chinese cities, i.e. Beijing, Wuhan and Chongqing.

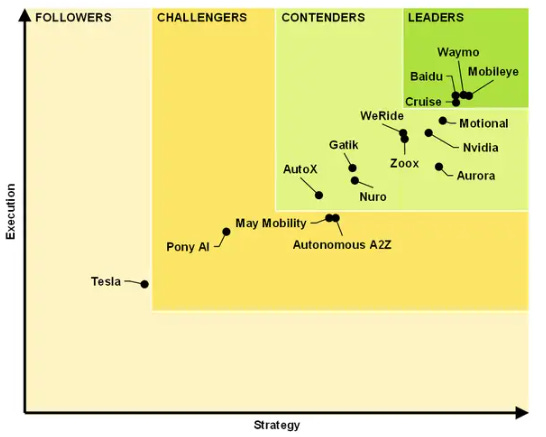

A study of Guidehouse Insights names these three companies together with Mobileye as leaders in the field. Tesla came in last. On the one hand you could argue that as these strong performers are only operating in a selected, small area, it’s logical that they have been able to optimize their product better. The acid test will be if they can roll out similar capabilities to other cities.

On the other hand a disadvantage for Tesla might be is that its cars don’t make use of lidar, and rely solely on cameras to detect the vehicles’ surroundings. Lidar is basically a laser-based radar system used to measure distances from a vehicle to the objects around it. Intuitively, it seems to me that this would bring in a strong advantage to the decision making process of any robotaxi system. As an AI system is basically analyzing 1s and 0s, I have some doubts whether it can get a proper feel for depth like having a pair of forward facing eyes does. Obviously lidar could bring in precise measurements to layer on top of the cameras’ vision capabilities.

The disadvantage of lidar is that the cost is still considerably high, coming in at several thousands of dollars. Although prices have been dropping steeply over the years and this is expected to continue. Velodyne, a Silicon Valley based lidar maker, expects prices to drop to $600 by 2024, down from $18,000 in 2017.

Tesla uses instead a feed from 8 cameras, each of which goes through a neural net to produce a unified vector space representing the vehicle’s surroundings. This vector then goes through another neural net for decision making. As such its AI system is basically a series of neural nets, feeding each other. The FSD software can calculate within 50 milliseconds which decision to make. This is fast enough, as the human reaction averages around 250 milliseconds.

So the autonomous driving business is somewhat of a mixed bag. On the one hand, theoretically Tesla should be in a strong position to capture this market. On the other, there is analysis suggesting competitors from the tech space are ahead. However, if this underperformance is indeed caused by a lack of lidar, there is nothing stopping Tesla from adding this component to their future cars. Which might propel them to a pole position in the future. Time will tell.

Dojo 道場

“We're continuing to simultaneously make significant purchases of Nvidia GPUs and also putting a lot of effort into Dojo, which we believe has the potential for an order of magnitude improvement in the cost of training. Dojo has the potential to become a sellable service that we would offer to other companies in the same way that Amazon Web Services offers web services. So I really think that the Dojo potential is very significant.” - Elon Musk.

Dojo is a supercomputer for AI training. The entire system is designed by Tesla from the chip to the racks connecting all this processing power. Once again the main aim of this here is to achieve large efficiency improvements.

For the auto labeling of images to train the AI model on, they expect to be able to replace 72 Nvidia GPU racks with 4 Dojo ones. For the training of the AI model itself, they expect Dojo to bring training time down from one month to less than a week.

Optimus

Optimus is a great concept, a humanoid robot aimed being able to take over all sorts of manual tasks. But perhaps it could become a friend and thus have social value as well. The technology to have conversations with computers is already here, with ChatGPT, as is the technology to generate human voices of all kinds. Thus it doesn’t take much imagination to see both of these implemented in a humanoid robot. The first goal of Optimus however is to be able to take over manual labor in Tesla’s manufacturing.

For the development of this robot, Tesla is leveraging from all their know-how and systems in the development of cars. For example, the previously discussed simulation software can be used to analyze the performance of Optimus and its components under various circumstances.

All of Optimus’ components are designed by Tesla: the actuators, the electric motor, the gearbox, the power electronics, and the battery pack. The robot will carry a battery pack with sufficient power for a full day of work. According to Musk, what will set Optimus apart is that it will have a ‘brain’ for general tasking. Which will be leveraged from Tesla’s FSD AI system.

Tesla estimates the selling price of an Optimus to be less than $20k. The version of Optimus which was presented at Tesla’s AI day last year had been in development for six months only. However, with all of the company’s know-how here, this could become an interesting product in the long run. It will be interesting to track how much progress they can make on this project in the coming years.

Manufacturing

Tesla currently has a capacity to produce two million vehicles per annum. Further expansion can be financed from operating cash-flow, so no new capital raising or new debt should be necessary.

Due to the company’s built-up manufacturing know-how, Tesla is able to expand operations fairly quickly. For example, Gigafactory Shanghai was completed in less 10 months. Recently Elon announced that the next one will be build in Mexico. A facility to manufacture the next gen vehicle. As production is still ramping up at Gigafactory Berlin and Texas, this will provide an automatic tail wind to margins in the coming years. And as these facilities ramp up, new markets for export can be opened up. The increased production will be shipped to South-East Asia and Australia, amongst others.

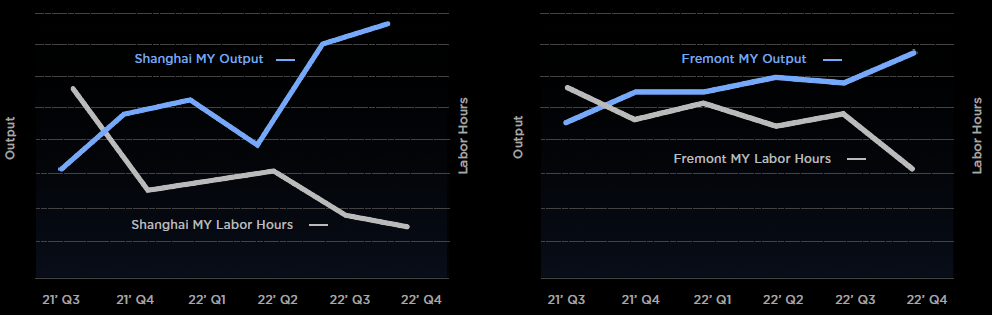

The charts below illustrate how even at more mature sites such as Fremont and Shanghai, further productivity improvements are still increasing output. The company has continuously been implementing increasing levels of automation.

For each of Tesla’s facilities the company aims to partner with local suppliers. So for Shanghai for example, 95% of the supply chain is localized. Which gives tremendous cost savings in transportation costs. The vehicle being produced in Shanghai is by far the cheapest.

Short seller Jim Chanos claimed that all of Tesla’s profits come from its Shanghai factory. As Texas, Berlin and Mexico ramp up, I expect going forward that the company will have a diversified profitability profile amongst its manufacturing sites. However, that said, Shanghai is clearly a very important facility and thus the company has clear geopolitical risk.

On the new cold war 2.0 between China and the US, Tesla’s view is that the company is a large employer in the region, including at its suppliers, and therefore they don’t expect to be the target of retaliation.

The mainstream media has claimed that Musk’s purchase of Twitter could bring him in the crosshairs of the Chinese Communist Party. Their reasoning being that the CCP disapproves of free speech platforms. My analysis here reaches the opposite conclusion. Musk operating the main information platform in the West with a free speech philosophy is a benefit to the CCP, as this gives any player in the world the chance to bring over their viewpoints and media publications to a Western audience.

From Matt Taibbi’s and Bari Weiss’ reporting, we know that with Twitter 1.0 under Dorsey, there were a tenfold of former US intelligence officers active at the company, also operating in censorship roles. With on top of that Twitter being pressured by various Washington agencies about which accounts to remove from the platform. From the viewpoint of the CCP, this is a much less desirable situation. Therefore I suspect that Beijing will see Musk’s acquisition of Twitter in a more positive light.

On the contrary, it is possible that various factions in Washington are seeing Musk as an opponent to their efforts to control the narrative in the US and the wider world. So perhaps the larger concern for Tesla shareholders is whether Washington will use its power to take retaliatory measures against the company and Musk. For example through the use of lawfare. Or through the smearing of the Tesla brand and Musk via the mainstream media. The below headlines illustrate how some media outlets are ramping up their attacks:

Charging Sites

Another competitive advantage for Tesla is that they have the largest charging network worldwide with more than 80,000 charging points, including 45,000 superchargers. The latter can recharge 170 miles of range within 15 minutes.

As components are shared across the company’s different product lines, Tesla estimates their deployment costs to be around 45% lower compared to competitors in this field. Due to efficiency gains in components used, the company has been able to cut the operating cost of a charging site by 40%.

The software in Tesla vehicles routes customers not necessarily to the nearest charging site, but one where charging points are immediately available. This has dramatically improved site utilization levels.

Currently Tesla is opening up these stations to vehicles from competitors. Over 50% of superchargers in Europe for example are now available to everyone. All you have to do is sign in to the Tesla app, unlock a post, and start charging.

Overall, I expect this to be a good business as it provides continuously recurring revenues, while it is not easy for new competitors to come in.

Energy Storage

“If you just look at what's needed to transition the world to a sustainable energy economy, there is more stationary energy storage needed than there is mobile energy storage. And we are seeing growth of our stationary storage well in excess of automotive, so that is in line with expectations. Megapack demand is quasi infinite. As long as we are competitive with utilities, we can sell as many Megapacks as we like.” - Elon Musk

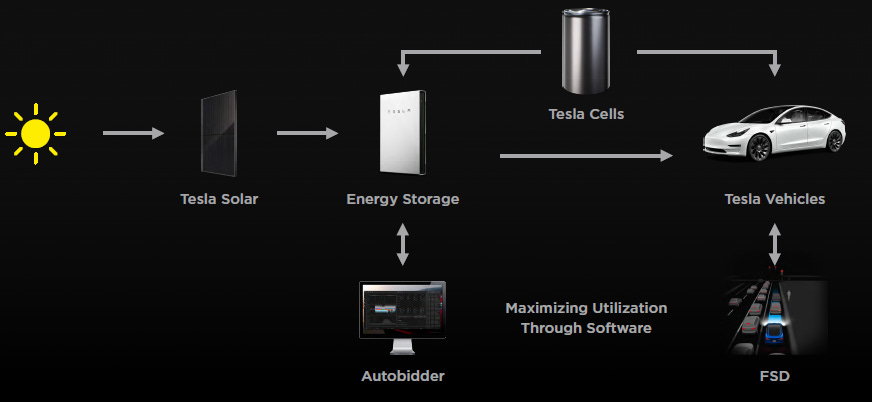

There are two products in the energy storage business: Powerwall and Megapack.

Powerwall is a battery that stores energy and is especially useful when combined with solar panels on your roof. This way during the day the battery can recharge. And in the evening, when your power consumption is highest, you can make use of your stored energy.

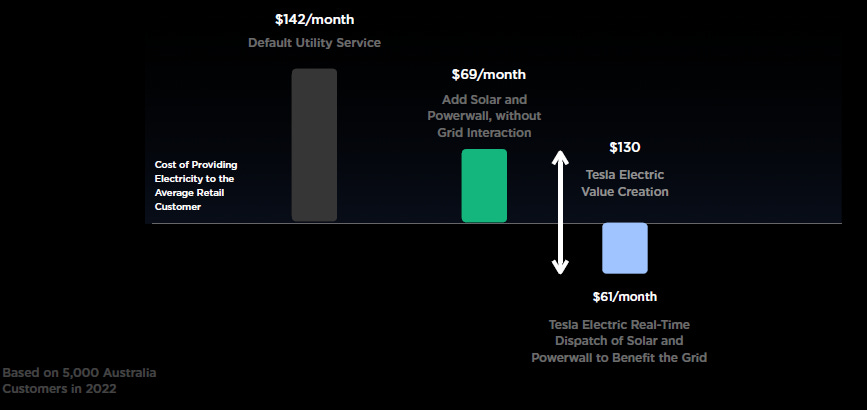

In the slide below, Tesla highlights that their customers in Australia are making $61 per month in income from Powerwall, as spare electricity can be sold to the grid via an automated software.

Megapack is basically the large scale version of Powerwall, where energy can be stored on an industrial scale. These products are similarly used to store energy when the wind is blowing or the sun is shining. Every single day on Earth, an abundant amount of energy can be captured from renewable resources. This energy can be stored then in large Megapack sites.

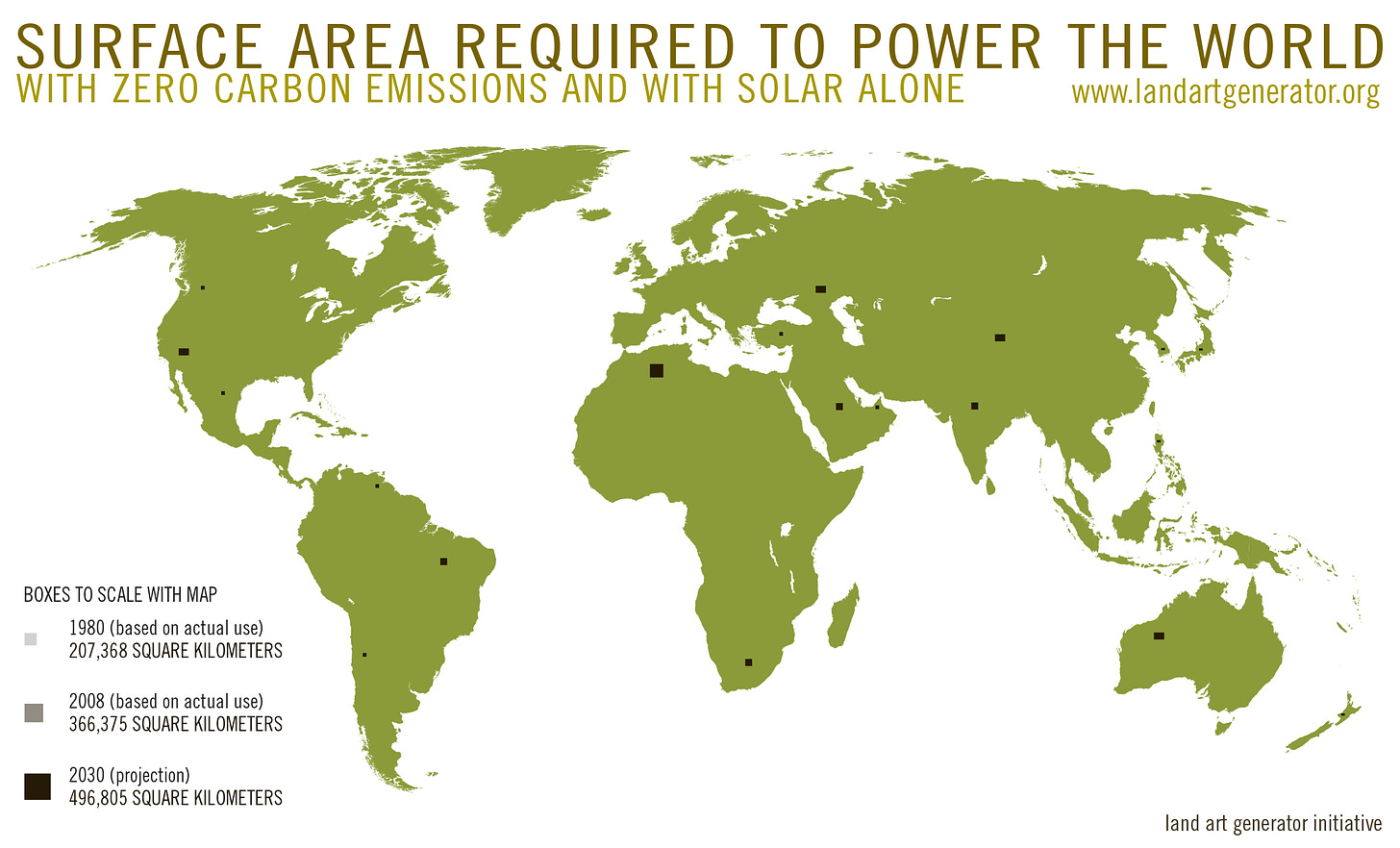

Currently wind farms are often being turned off during the night, as winds are blowing most strongly then but at the same time, demand for power is low. This is a complete waste of energy which going forward can be captured then with battery sites. Similarly, think of all the solar energy which could be captured in deserts. Actually, not that much land mass has to be devoted to solar installations to power the world, as is illustrated on the map below. Megapack should be able to become a lucrative business.

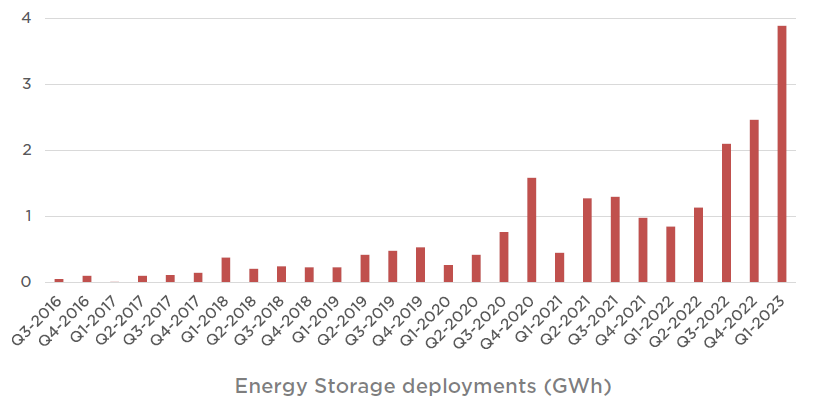

The chart below highlights that this energy storage business is showing high growth. Tesla recently announced to build a new Megapack factory in Shanghai with a capacity of 40 Gwh annually. That will be its second site, as the company is already operating a similar plant in California with the same output potential.

Tesla has written a specialized software so that these Megapack sites can be used for grid balancing. Supply and demand of energy on the grid always has to match. According to some testimonials from utility companies, this software provides a much more stable way of balancing the grid compared to conventional methodologies.

In conclusion, Tesla is not only a hardcore engineering company but also probably the ultimate green company, providing a complete suite of products to transition the economy to a renewable future:

Financials - share price at time of writing is $168, ticker ‘TSLA’ on the Nasdaq

“And while we reduced prices considerably in early Q1, it's worth noting that our operating margin remains among the best in the industry. We've taken a view that pushing for higher volumes and a larger fleet is the right choice here. However, we expect our vehicles, over time, will be able to generate significant profit through autonomy. So we do believe we're like laying the groundwork here, and that it's better to ship a large number of cars at a lower margin, and subsequently, harvest that margin in the future aswe perfect autonomy. This is an extremely important point.

The desire for people to own a Tesla is extremely high. The limiting factor is their ability to pay for a Tesla. One of the things we weren't sure about was the price elasticity of demand for Tesla. So like as we lower the price, how much does demand increase? And we found that even small changes in the price have a big effect on demand, very big.” - Elon Musk

Tesla has been lowering prices in recent quarters due to the economic macro headwinds. A lot of people buy a car on a loan, so higher interest rates automatically increase monthly payments, making a new car less affordable. Similarly other customers hold back more on large expenses. However, last week, the company made again some small price increases. Due to the visibility the company has on the daily demand for their vehicles, they can adjust prices to balance supply and demand.

The CFO also discussed cost reduction measures, which should result in margin improvements, as well as some other interesting topics:

“Progress on vehicle cost reduction continued in Q1 with meaningful improvements on logistics and the beginnings of some commodity cost reductions starting to be realized. Per unit cost for Austin and Berlin improved as well, driven by record volumes. However, these factories still provide a margin headwind and will likely continue to do so until after we reach and stabilize at our intended volumes. Note that Q1 was our third quarter in our multi-quarter plan to move to a more regionally balanced mix of build and deliveries. As I've mentioned previously, this results in lower deliveries and production within a quarter due to a higher volume of cars in transit at the end of the quarter as we begin exporting cars for international deliveries.

Within the bucket of things we control, the most of the cost down that we're working on is around ramping our Austin factory, stabilizing that and then doing the cost optimization work once we get to our intended volumes there. And so over the course of this year, as volume increases, more localization occurs, we do see a good path to cost reduction in the Berlin factory as well. In existing factories, too, we talk about this on every call, so I don't need to rehash it, but the expectation is that every existing factory improves all of their key metrics.

And then there's the commodities world, which has been a huge pinch point in our cost structure over the last 2 years, and we're still kind of at the maximum of pain for commodities in our cost structure. We did start to see in Q1 a little bit of improvement. We think there'll be a little bit more improvement in Q2 and have a more meaningful impact in the second half of the year. We were able to take advantage of low lithium pricing earlier on with fixed-price contracts. And we find that this is going to be another opportune moment to basically extend that into the later half of the decade.

With respect to operating margins, we intend to continue to improve operating expenses as a percentage of revenue over time. And we're continuing to take cost out of our products and try to keep gross margins at a place that's healthy as well.” - CFO during Q1 call

Looking at consensus estimates, the sell side expect revenues to double during the coming three years, which at their estimated EBITDA margin of 22% would bring Tesla’s next-twelve-month’s EV / EBITDA to a valuation of 15x by the end of ‘24. For comparison, Toyota is on 12x. The risk to these numbers is that Tesla will go into a protracted price war with new and higher cost competitors to drive them out of the market. This could be sensible from a long-term viewpoint, it would allow Tesla to take a large market share of the EV market by eliminating competition. However, this could bring weakness in the share price in the near term. On the positive side, the scaling up of Texas and Berlin should bring in margin improvements, as well as commodity costs having come down.

Due to the growth Tesla has been generating, the company has become very cash generative. Allowing them to reduce their debt levels while building up cash. This has resulted in a current net cash position of around $17bn. Therefore in my opinion, investors can start anticipating a share buyback program in the coming years.

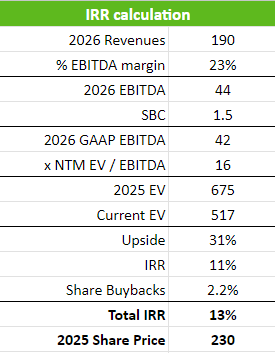

In the below modelling, I start from 2026 revenues of $190 billion. Multiplying my number with an EBITDA margin of 23% gives around $44 billion in 2026 GAAP EBITDA, after the deduction of $1.5 billion for share based compensation (SBC). There’s reason to think that the company can do better than this as software will increase in the mix and economies of scale should allow for further margin expansion. On the other hand, the competitive environment can be more intense. Therefore, I took a middle ground taking a margin which the company already surpassed last year. Putting the EBITDA on a 16x next-twelve-months multiple gives an internal rate of return (IRR) of 11% till the end of 2025. For comparison, Toyota is currently on 12x, while Apple is on 19x. Tesla will be building up a huge cash pile over the coming years, part of which should start being returned to shareholders. Taking 2024 free cash flow to equity as the average amount of capital that can be returned over these years, this should result in a share buyback of around 2.2% per annum on the current market cap. Resulting in a total IRR of around 13% and giving a share price of $230 by the end of 2025.

Obviously there are more positive as well as negative scenarios which could play out. A successful development of full self driving would be a huge boon for shareholders. On the other hand, an extremely competitive environment in the EV market could weigh on margins for a number of years.

If you enjoy research like this, hit the like button (at the bottom) and subscribe. Also, share a link to the research on social media with a positive comment, it will help the publication to grow.

For day-to-day updates on financial markets and the tech sector, follow me on Twitter.

You can find an overview of all my research here.

Disclaimer - This article doesn’t constitute investment advice. While I’ve aimed to use accurate and reliable information in writing this, it cannot be guaranteed that all information used is of such nature. The projected IRR is a subjective calculation based on what I estimate a likely and reasonable scenario for the shares to be, however, the shares’ future performance remains uncertain and a more negative scenario could play out. The views expressed in this article may change over time without giving notice. Please speak to a financial adviser who can take into account your personal risk profile before making any investment.

Excellent company breakdown!

Ok, smal EV start ups sqeezed out. Agree. I don't believe that this will result in a drastic change to the pricing and ROIC dynamics of the industry.

What would you put the odds for Toyota, VW, BMW, DAI, GM, F, RNO etc. not beeing around in ten years producing cars (EVs..)? Several of them has gov ownership + long history of bust and bailout.

I believe the dynamics of the auto industry do not permit a shift towards an oligopolistic market structure with any kind of pricing power. It appears we have a difference of opinion on this matter. I must admit that I don't find your arguments particularly persuasive.